General FAQ

GENERAL FAQ

Question: What does BURS stand for?

Answer:Â Botswana Unified Revenue Service

Question: Who heads the operations of BURS?

Answer:Â BURS is headed by a Chief Executive Officer, designated as Commissioner General.

Question: When was it established?

Answer:Â The Botswana Unified Revenue Service (BURS) was established by an Act of Parliament in 2004, the Botswana Unified Revenue Service Act of 2003 and came into operation in August 2004.

Question: Why was it formed?

Answer:Â BURS was established at a time when efficient tax collection was identified as a necessary part of the Government’s ability to fulfil both its governance and its civic duties.

Question: Which Departments were merged?

Answer:Â The Departments of Customs & Excise and Taxes were brought together to form BURS. These now make up the core divisions of BURS namely Customs & Excise Division and Internal Revenue Division.

Question: What is the mandate of BURS?

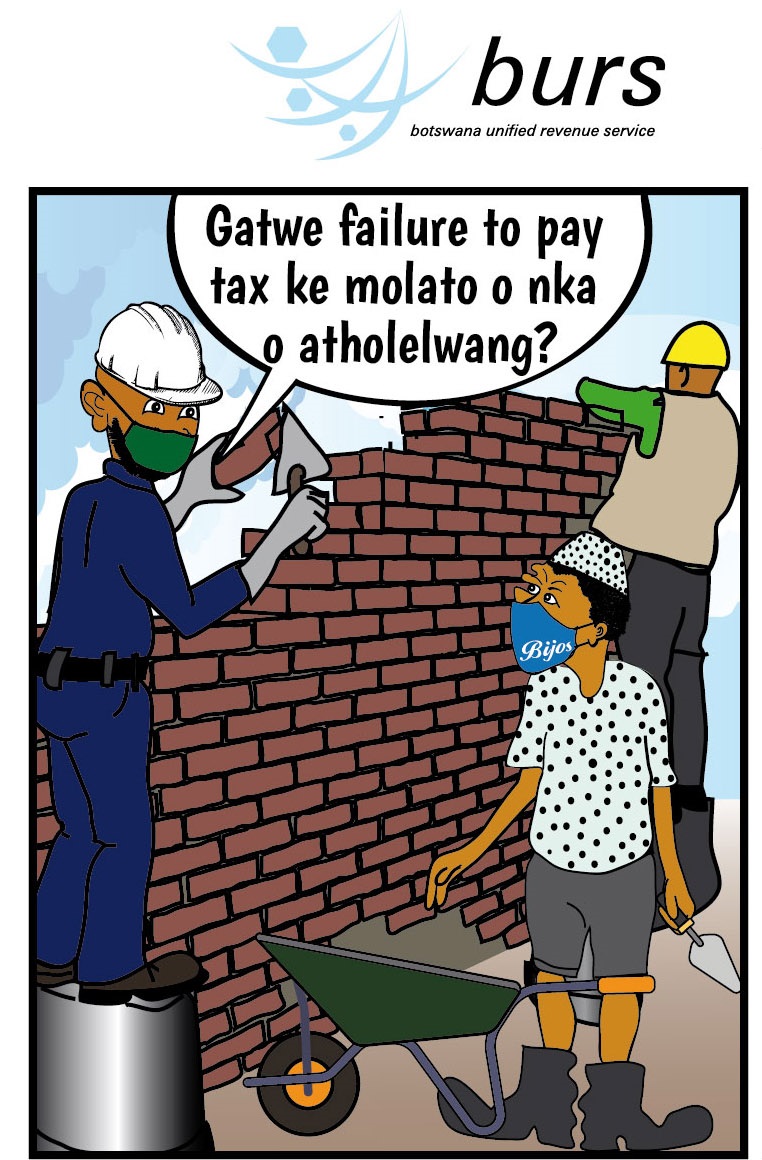

Answer:Â The mandate of BURS is to perform tax assessment and collection functions on behalf of the Government of Botswana and to take appropriate measures to counteract tax evasion and to improve taxpayer service.

Question: Which Revenue Acts does BURS administer?

Answer:Â BURS administers 4 (four) Revenue Acts; Income Tax, Value Added Tax (VAT), Customs & Excise and Capital Transfer TaxÂ

Question: How is BURS spread across the country?

Answer:Â BURS has a head-office based in Gaborone, five regional offices in Francistown, Gaborone, Lobatse, Maun and Selebi-Phikwe, four satellite offices in Jwaneng, Mahalapye, Palapye and Serowe and is responsible for all borders, airports and airfields in the country.